Wondering how much car insurance in Wisconsin will cost you? You’re not alone.

Finding the right coverage without breaking the bank can feel confusing. But knowing what to expect can save you time and money. You’ll discover the key factors that affect your insurance rates and tips to get the best deal. Keep reading to take control of your car insurance and protect your wallet.

Credit: gearjunkie.com

Car Insurance Costs In Wisconsin

Car insurance costs in Wisconsin vary widely depending on several factors. Understanding these costs helps drivers budget better and choose suitable coverage. Rates depend on the type of vehicle, driving history, and other personal details. Wisconsin’s insurance market offers different prices based on many variables.

Average Premiums By Vehicle Type

Insurance premiums change according to the vehicle you drive. Some cars cost more to insure than others. Here are average annual premiums by vehicle type in Wisconsin:

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,100 |

| SUV | $1,300 |

| Pickup Truck | $1,200 |

| Sports Car | $1,800 |

SUVs and sports cars typically have higher premiums. Sedans often come with the lowest rates. Pickup trucks fall in the middle range.

Factors Influencing Rates

Several key factors influence Wisconsin car insurance rates. Insurance companies consider:

- Driver’s age and gender

- Driving record and claims history

- Location within Wisconsin

- Vehicle make, model, and year

- Credit score

- Coverage limits and deductibles

Young drivers pay more due to inexperience. Urban areas may have higher rates because of traffic and theft risks. Choosing higher deductibles can lower premiums. Good driving habits and clean records reduce costs significantly.

State Requirements For Coverage

Wisconsin law sets specific rules for car insurance coverage. These rules ensure drivers have enough financial protection on the road. Meeting these requirements helps protect you and others in case of accidents. It also affects how much car insurance costs in Wisconsin.

Minimum Liability Coverage

Every driver in Wisconsin must carry liability insurance. This covers injuries or damage to others if you cause an accident. The state requires these minimum amounts:

- $25,000 for injury or death of one person

- $50,000 for injury or death of two or more people

- $10,000 for property damage

This minimum coverage helps cover basic costs but may not be enough for serious accidents. Driving without this coverage can lead to fines and license suspension.

Optional Coverage Options

Besides minimum liability, drivers can choose extra coverage. These options add more protection and reduce out-of-pocket costs after a crash.

- Collision coverage:Pays for damage to your car from a crash.

- Comprehensive coverage:Covers damage from theft, fire, or weather.

- Uninsured motorist protection:Protects you if the other driver has no insurance.

- Medical payments coverage:Helps pay medical bills for you and passengers.

Adding optional coverage increases your premium but offers better peace of mind. Choose options based on your needs and budget.

Regional Rate Variations

Car insurance rates in Wisconsin change based on the region you live in. Different areas have different risks. Insurance companies look at these risks to set their prices. Understanding regional rate variations helps you see why rates differ across the state.

Urban Vs Rural Differences

Urban areas in Wisconsin often have higher car insurance rates. More cars mean more accidents and thefts. Crowded streets increase chances of collisions. Insurance companies see urban drivers as higher risk.

Rural areas usually have lower rates. Less traffic means fewer accidents. But some rural regions have higher rates due to longer emergency response times. Insurance costs reflect these local conditions.

Impact Of Local Traffic Patterns

Traffic flow affects car insurance prices. Busy highways and intersections raise accident risks. Areas with frequent traffic jams may see higher claims. Insurance rates rise to cover these risks.

Regions with smoother traffic and fewer stops often have lower rates. Less congestion means fewer chances for crashes. Insurance companies use traffic data to adjust premiums.

Credit: www.youtube.com

Discounts To Lower Your Premium

Car insurance premiums in Wisconsin can vary widely. Discounts help lower these costs and make coverage more affordable. These savings reward good habits and responsible choices. Understanding available discounts can reduce your payments significantly.

Safe Driver Discounts

Drivers with a clean record often pay less. Insurance companies reward those without accidents or tickets. Staying accident-free shows careful driving. This discount encourages safer roads for everyone.

Multi-policy Savings

Bundling home and auto insurance saves money. Insurers offer discounts for multiple policies. Combining coverage reduces overall costs. It simplifies payments and increases savings too.

Good Student Discounts

Students with good grades can get lower rates. Insurers see good grades as a sign of responsibility. This discount helps young drivers save money. Keeping grades up benefits both school and insurance bills.

Tips For Finding Affordable Insurance

Finding affordable car insurance in Wisconsin doesn’t have to feel like a guessing game. With the right approach, you can lower your premiums without sacrificing the coverage you need. The key is knowing where to focus your efforts and how to make smart choices that benefit your wallet and peace of mind.

Comparing Quotes Effectively

Getting multiple quotes is essential, but how you compare them matters just as much. Look beyond the price—check what each policy covers and any exclusions that might affect you. Sometimes a cheaper policy can cost you more out of pocket if it lacks important protections.

Use online tools that let you enter the same information for each insurer to get accurate comparisons. Don’t forget to ask about discounts specific to Wisconsin drivers, such as those for safe driving or bundling with home insurance.

Choosing The Right Coverage

Picking coverage isn’t about choosing the cheapest option—it’s about choosing what fits your needs. Ask yourself how much risk you can handle financially if something happens. For example, raising your deductible can lower your premium, but will you be able to pay that amount easily after an accident?

Consider state requirements versus additional coverage that protects your assets. Liability limits should reflect your financial situation, and adding uninsured motorist coverage can be a lifesaver in Wisconsin, where accidents happen.

Improving Your Risk Profile

Your personal profile influences your rate more than you might realize. Simple actions like maintaining a clean driving record can lower your premiums significantly over time. Have you checked your credit score lately? Some insurers use it to determine risk, so improving it might save you money.

Installing safety devices or taking a defensive driving course can also make insurers see you as less risky. These small investments often pay off with notable discounts. What changes can you make today that might reduce your insurance costs tomorrow?

Credit: www.reddit.com

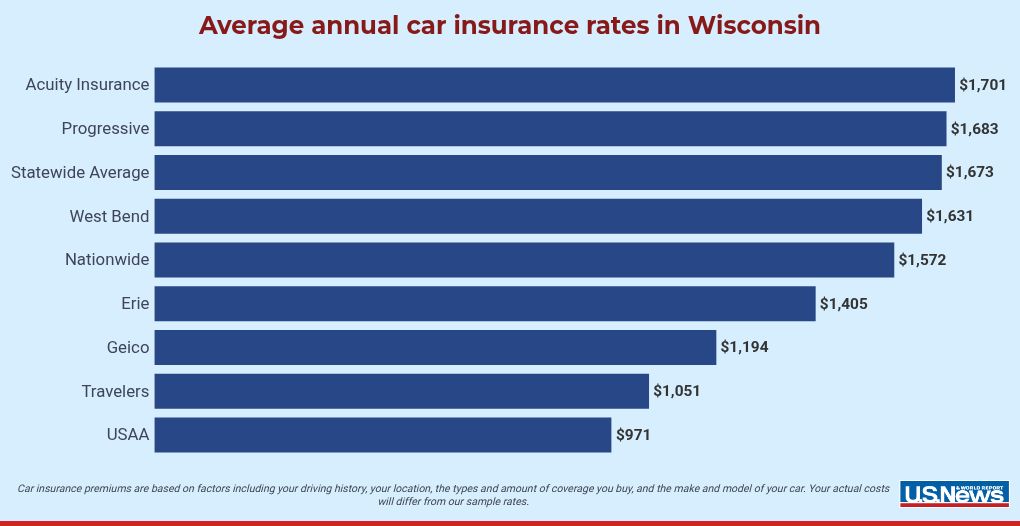

Popular Insurers In Wisconsin

Choosing the right car insurance provider in Wisconsin matters. Many companies offer various plans and benefits. Understanding popular insurers can help you find better coverage at fair prices. This section highlights the main players and how customers feel about them.

Top Companies By Market Share

Several insurers hold large shares in Wisconsin’s market. These companies have many policyholders and wide coverage options. Here are some leading ones:

- State Farm – Known for extensive local agents and strong financial backing.

- GEICO – Offers competitive rates with a focus on online services.

- Progressive – Popular for flexible policies and discounts.

- American Family – A Wisconsin-based company with tailored coverage.

- Allstate – Provides various plans with added roadside assistance options.

Customer Satisfaction Ratings

Customer feedback helps reveal service quality and claims handling. Wisconsin drivers rate insurers on responsiveness and ease of claims. Here is a summary of satisfaction levels:

| Insurance Company | Customer Satisfaction Score (out of 5) | Comments |

|---|---|---|

| State Farm | 4.5 | Quick claim processing and helpful agents. |

| GEICO | 4.2 | Affordable rates and easy online management. |

| Progressive | 4.0 | Good discounts but mixed claim reviews. |

| American Family | 4.3 | Personalized service with local support. |

| Allstate | 4.1 | Reliable coverage and roadside assistance. |

Frequently Asked Questions

What Is The Average Car Insurance Cost In Wisconsin?

The average car insurance cost in Wisconsin is approximately $1,100 per year. Rates vary based on factors like age, driving history, and coverage type. Wisconsin’s rates are generally lower than the national average, making it an affordable option for many drivers.

How Can I Get Cheaper Car Insurance In Wisconsin?

To get cheaper car insurance in Wisconsin, compare quotes from multiple providers. Consider increasing your deductible and maintaining a clean driving record. Bundling insurance policies and taking advantage of discounts can also help reduce your premium.

What Factors Affect Car Insurance Rates In Wisconsin?

Car insurance rates in Wisconsin are influenced by several factors. These include your age, driving history, vehicle type, and location. Credit score and coverage options also play a role. Insurers assess these factors to determine your premium.

Is Car Insurance Mandatory In Wisconsin?

Yes, car insurance is mandatory in Wisconsin. The state requires drivers to have liability coverage. This includes bodily injury and property damage coverage. Proof of insurance must be carried at all times while driving.

Conclusion

Car insurance costs in Wisconsin vary by many factors. Age, driving history, and car type affect prices. Comparing quotes helps find the best deal. Choosing the right coverage is important for protection. Staying safe on the road can lower your rates.

Knowing these points makes buying insurance easier. Start now to find a plan that fits you. Simple steps lead to smart choices.